Colorado 1099-G Tax Refund: A Deep Dive Into What You Need To Know

Alright, let’s get straight to the point—tax season can be a headache, but if you’re in Colorado and dealing with a 1099-G form, you’re not alone. Whether you’ve received a refund from the government or had other payments reported on this form, understanding how it ties into your taxes is crucial. So, buckle up because we’re about to break it down for you in a way that’s easy to digest.

When you hear the term "Colorado 1099-G tax refund," it might sound like a bunch of random letters and numbers, but trust me, it’s important stuff. This form isn’t just some piece of paper or digital file; it’s a key part of your tax return. If you’ve ever wondered why you got a refund—or why you didn’t—this is where it all starts making sense.

Now, I know what you’re thinking: “Do I really need to know all this?” The short answer is yes. Ignoring your 1099-G could mean missing out on money you’re entitled to—or worse, owing more than you should. So, let’s take a closer look at what this form means, how it impacts your refund, and how to make sure you’re getting everything you deserve.

Read also:How To Viralkand The Ultimate Guide To Making Your Content Go Viral

What Exactly is the Colorado 1099-G Form?

The 1099-G form is essentially the IRS’s way of letting you know about certain payments you received from the government during the year. In Colorado, these payments could include unemployment benefits, state tax refunds, or any other government-related income. Think of it as a report card for your finances—but instead of grades, it’s all about dollars and cents.

Here’s the kicker: if you got a tax refund last year, that amount will show up on your 1099-G. Why? Because the IRS wants to make sure you don’t pay taxes on money you’ve already been taxed on. Makes sense, right? Well, sort of. But don’t worry—we’ll break it down further so you can wrap your head around it.

Why Does the 1099-G Matter for Your Refund?

Let’s say you got a fat refund from Colorado last year. Great news, right? Well, here’s the thing: when you file your taxes this year, the IRS is going to want to know about that refund. If you don’t report it correctly, you could end up owing more—or worse, getting audited. Nobody wants that.

On the flip side, if you didn’t get a refund last year but are expecting one now, your 1099-G could help boost that amount. It’s all about balancing the books and making sure everything adds up. And trust me, the IRS has a way of catching mistakes, so it’s better to get it right the first time.

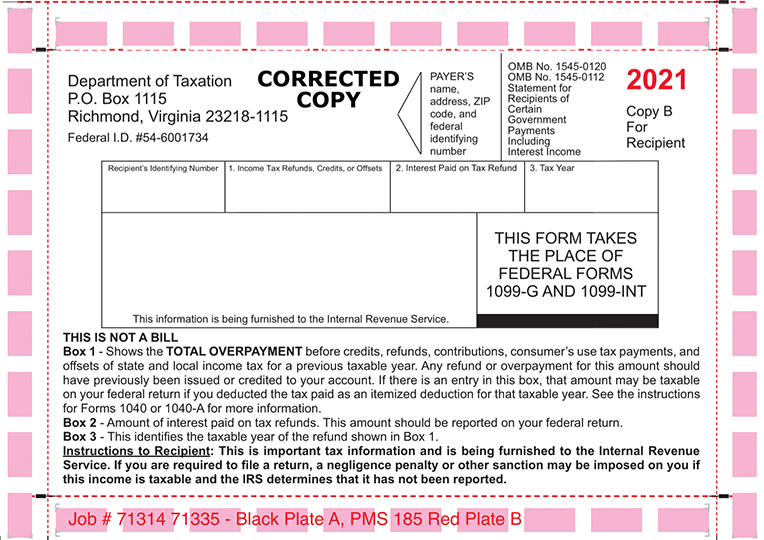

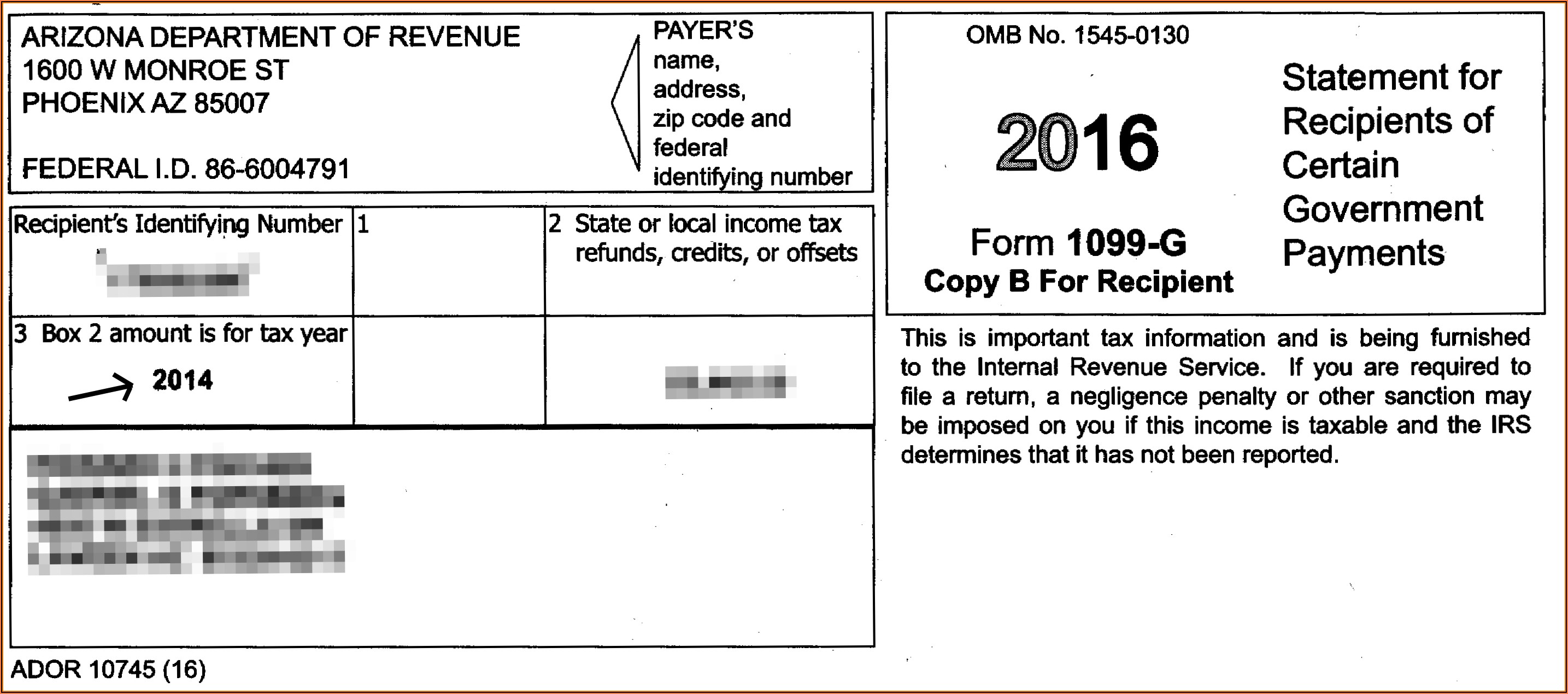

How to Read Your Colorado 1099-G Form

Now that you know what the form is, let’s talk about how to read it. The 1099-G might look intimidating at first glance, but once you understand the key sections, it’s actually pretty straightforward. Here’s a quick breakdown:

- Box 1: This is where you’ll find the total amount of unemployment compensation you received during the year.

- Box 3: This box shows the amount of any state or local tax refunds you got last year.

- Box 5: If you received any other payments from the government, like grants or credits, they’ll show up here.

Remember, each box tells a different part of your financial story. Don’t skip over anything—every number matters when it comes to your refund.

Read also:Hyungry Leak The Untold Story Behind The Hype

Common Mistakes to Avoid with Your 1099-G

Okay, so you’ve got your form in hand. Now what? First things first, don’t make these common mistakes:

- Forgetting to report your refund from last year. Yep, that’s a big no-no.

- Not double-checking the numbers on your form. Typos happen, and they can cost you big time.

- Thinking you don’t need to file because you didn’t earn much. Newsflash: even small amounts count!

By avoiding these pitfalls, you’ll be setting yourself up for a smoother tax season—and hopefully a bigger refund.

How Colorado’s 1099-G Impacts Your Federal Taxes

Here’s where things get interesting. While your 1099-G is issued by the state of Colorado, it also plays a role in your federal tax return. Why? Because the IRS and the state work together to ensure everything checks out. If you received a refund from Colorado last year, you’ll need to report it on your federal taxes too.

But here’s the good news: you won’t be taxed on the full amount of your refund. Instead, the IRS looks at whether the deduction you claimed last year was greater than your standard deduction. Confusing? Maybe a little, but it’s all about fairness and making sure everyone pays their fair share.

Tips for Filing with a 1099-G in Colorado

Ready to file? Here are a few tips to make the process as painless as possible:

- Use tax software or hire a professional if you’re unsure. Technology and experts are your friends during tax season.

- Keep copies of all your documents. You never know when you’ll need them again.

- Double-check everything before submitting. Once your return is in, it’s not easy to go back and fix mistakes.

And remember, if you’re feeling overwhelmed, you’re not alone. Millions of people go through this every year, and there are plenty of resources available to help you navigate the process.

Understanding Colorado Tax Refunds

Now that we’ve covered the 1099-G form, let’s zoom out a bit and talk about tax refunds in general. In Colorado, refunds can come from a variety of sources, including overpaid taxes, credits, and deductions. The key is knowing how to maximize your return without going overboard.

One thing to keep in mind: refunds aren’t free money—they’re essentially the government giving back what you overpaid throughout the year. So, while it’s always nice to get a check in the mail, it’s also a sign that you might want to adjust your withholdings for next year.

Common Questions About Colorado Tax Refunds

Let’s tackle some of the most frequently asked questions about refunds in Colorado:

- How long does it take to get my refund? Typically, refunds are processed within 21 days, but that can vary depending on how you filed and whether there are any issues with your return.

- What happens if my refund is delayed? If you don’t receive your refund within the expected timeframe, you can check the status online or contact the IRS for assistance.

- Can I claim my refund from last year if I didn’t file? Unfortunately, no. You only have three years to claim a refund before it’s considered forfeited.

Armed with this knowledge, you’ll be better prepared to handle any hiccups that come your way.

Maximizing Your Colorado 1099-G Tax Refund

Who doesn’t want a bigger refund? Let’s talk about some strategies for maximizing your return:

- Claim all applicable deductions and credits. Don’t leave money on the table!

- Double-check your math. Even small errors can add up over time.

- Consider itemizing if it makes sense for your situation. Sometimes this can lead to a larger refund.

Remember, the goal isn’t just to get a refund—it’s to make sure you’re paying the right amount of taxes overall. A good refund is a sign that your finances are in order, but an overly large refund might mean you’re overpaying throughout the year.

Resources for Colorado Taxpayers

Need more help? Here are some resources to check out:

- Colorado Department of Revenue: Their website has tons of useful information about state taxes and refunds.

- IRS Website: For federal tax questions, this is the go-to source.

- Tax Professionals: If you’re really stuck, consider hiring a CPA or tax attorney to help you navigate the process.

With these tools at your disposal, you’ll be well-equipped to tackle whatever tax season throws your way.

Conclusion: Taking Control of Your Colorado 1099-G Tax Refund

So, there you have it—a comprehensive guide to Colorado 1099-G tax refunds. From understanding the form to maximizing your return, we’ve covered all the bases. But remember, the most important thing is taking action. Don’t wait until the last minute to file your taxes—get started early and give yourself plenty of time to review everything carefully.

And hey, if you found this article helpful, don’t forget to share it with your friends and family. Knowledge is power, and the more people who understand their taxes, the better off we all are. Now, go out there and claim that refund—you’ve earned it!

Table of Contents

- What Exactly is the Colorado 1099-G Form?

- Why Does the 1099-G Matter for Your Refund?

- How to Read Your Colorado 1099-G Form

- Common Mistakes to Avoid with Your 1099-G

- How Colorado’s 1099-G Impacts Your Federal Taxes

- Tips for Filing with a 1099-G in Colorado

- Understanding Colorado Tax Refunds

- Common Questions About Colorado Tax Refunds

- Maximizing Your Colorado 1099-G Tax Refund

- Resources for Colorado Taxpayers